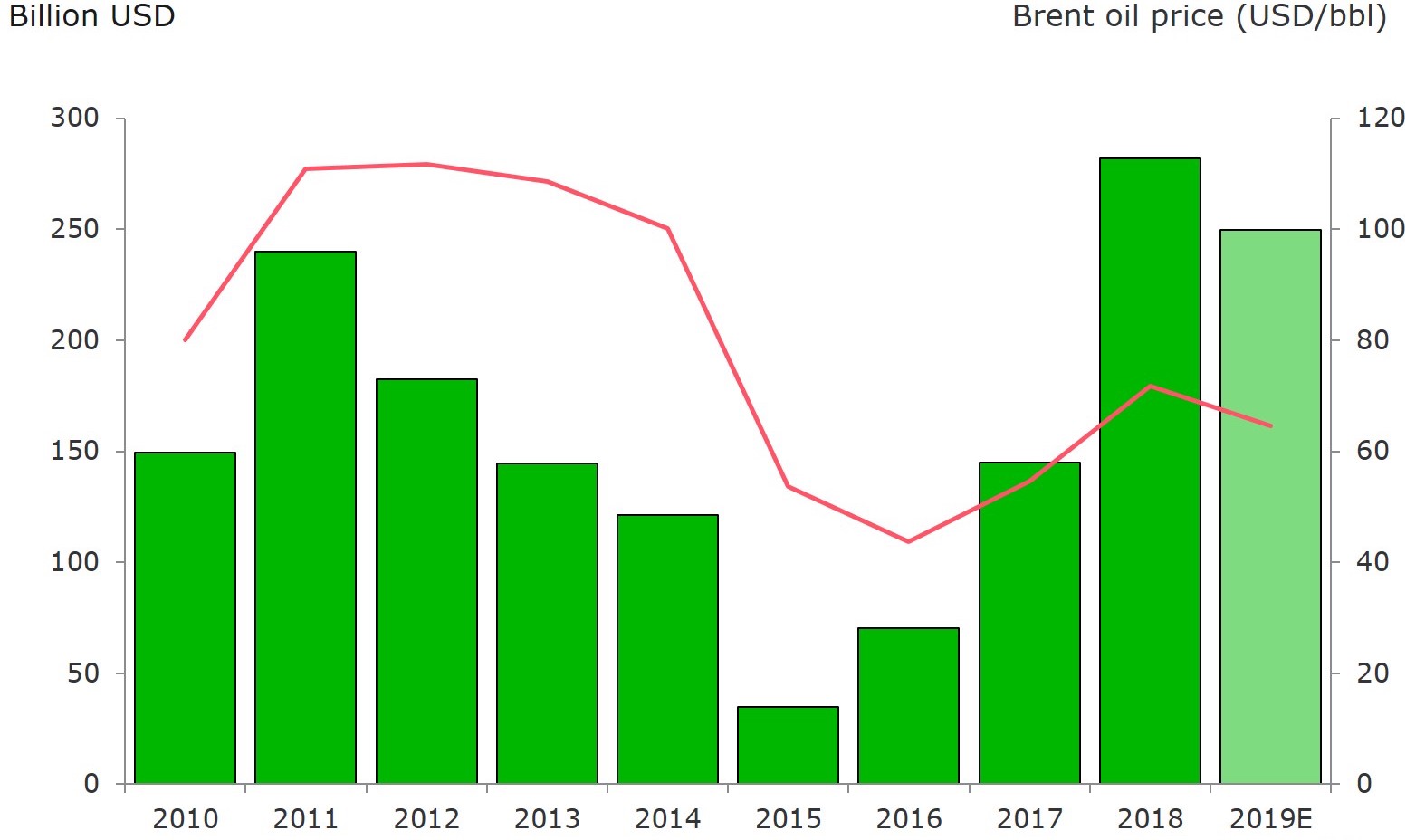

Last year saw a major turnaround in publicly listed E&P companies’ free cash flow fortunes to levels not seen since before the mid-decade downturn. According to energy analyst Rystad Energy, free cash flow for E&P firms reached nearly $300 billion in 2018, marking a return to so-called “super profits” for industry majors.

Courtesy of Rystad Energy

What accounts for this increased profitability? Rystad points to a combination of recovering oil prices (Brent crude futures closed at $71/bbl on Apr 9), lower development costs (new project developments are 30% less expensive than five years ago), and lower global activity (global E&P investments have fallen from $900 billion to $500 billion).

EMAG’s own research supports these findings. In a study of the Marcellus/Utica plays in the northeastern US earlier this year, we found that improvements to drilling and hydraulic fracturing techniques have helped lower development costs in the area. At the same time, the new-well gas production per rig keeps climbing, as this month’s EIA Drilling Productivity Report highlights. Other producing regions, most notably the Haynesville, Permian and Bakken, show similar production growth per rig.

While rising free cash flows is welcome news for E&P companies and their investors, what does it mean for energy services companies? The road to recovery will likely be longer for service providers, many of whom have not been able to raise their rates anywhere close to the levels of 2014.

Achieving greater profitability will likely require service providers to package their offerings in ways that deliver additional tangible value to operators. For example, some combination of greater collaboration and more usage of digital technologies can drive further operating efficiencies and boost production—and justify higher service rates in the process.

Check back with EMAG as we continue following this developing story.