Curious about what the future holds? We’ve run some quick scenarios to frame out what the future might hold for the water business in oil and gas. EnergyMakers has long advised clients to mitigate price swings and drilling fall-off by maintaining a production-related foundation to the business. The benefit of this strategy is about to become painfully evident for some companies, and potentially lucrative for others.

Since we don’t know how long it will take to reach oil price stability, or how that relates to operator spending and Wall Street’s willingness to finance our industry, we ran a series of best-to-worst scenarios looking at water volumetrics as they relate to various well completion rates going forward.

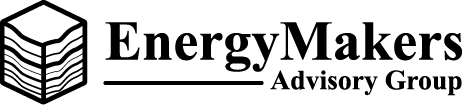

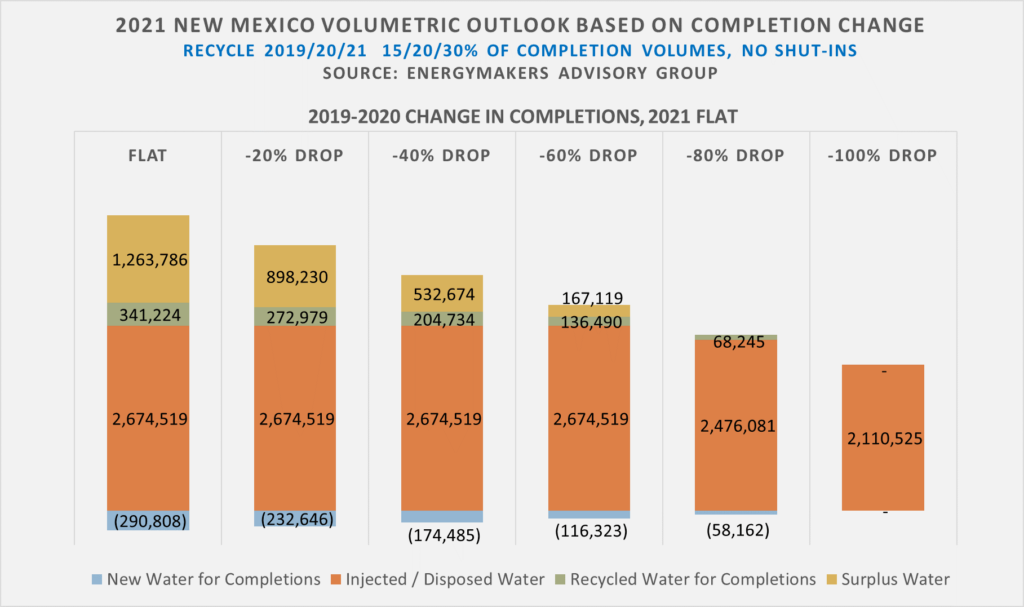

This particular study looks at Southeast New Mexico’s Delaware basin and surrounding area production in Lea and Eddy Counties. We ran volumetric outlooks assuming 2020’s new well completions for the area drop from 2019 levels by 20%, 40%, 60%, and 80%. Once each drop was reached, we assumed the number of completions would remain flat thereafter. Values cited are for calendar year 2021. We also looked at scenarios where 2019 completions were unchanged in 2020 (we wish!) and a theoretical outlook of zero new wells completed in 2020 (there have already been some 261 completions in 2020). Note that we did not reflect impacts to produced water volumes from possible future oil and gas well shut-ins (and that could make quite a difference if it were to occur, not reflected).

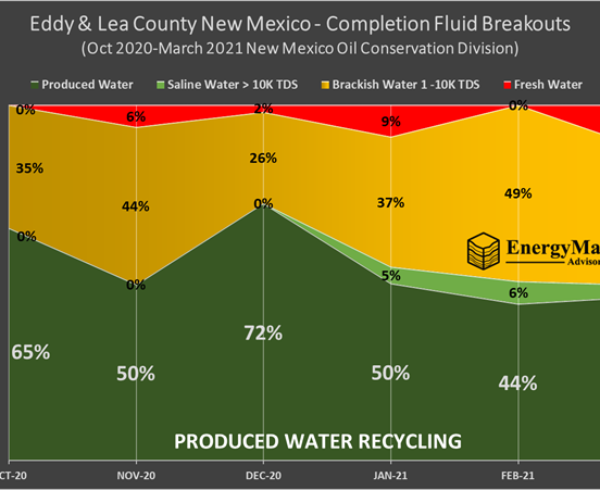

For historical reference, the last public forecast we did before the 2020 price crash showed the following volumetrics for New Mexico, based on EnergyMakers’ estimates of:

- Rates that regulators would allow new SWD capacity, and the

- “Practical capacity” of the SE New Mexico disposal well system.

Our assumptions around disposal well capacity, frac flowback, and completion volumes were not changed.

Our logic assumes per-barrel costs range from low to high as follows and that operators will choose what is least expensive, while still meeting their requirements.

- Recycled produced water – treated and transported

- New Completion fluid (brackish or fresh) – acquired, transported, modestly treated

- Local Disposal – transport and dispose

- “Surplus Water” – Produced water minus locally disposed water minus locally recycled water – must be piped out of state or treated to discharge standards.

The figure below highlights the SE New Mexico volumetric outlook for year 2021 based on various 2019-2020 reductions in annual well completions:

As a frame of reference, if we drilled no more new wells starting in May, completions would be down about 80% for 2020.

Each of the sub-basins in the Permian behave quite differently, and the Delaware basins in Texas has different constraining factors than the Delaware basin in New Mexico. Results from one basin don’t necessarily translate to other regions. The New Mexico Delaware basin is among the more interesting due to the state’s arid conditions, historic high levels of oil and gas development, constraints on shallow and moderate disposal capacity, frequent drought conditions, and freshwater constraints.

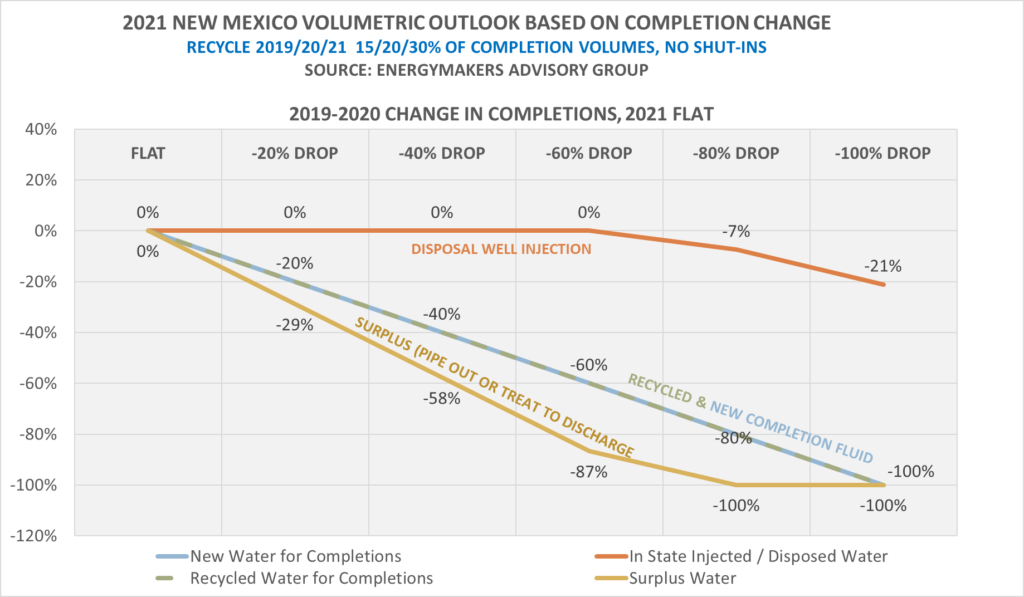

Here are potential volumetric changes in New Mexico by type of service, as compared to 2019-2020 completion rate changes:

Under all completion scenarios in New Mexico, we will rely (and generally well-utilize) our EOR and Disposal Wells, even under the most severe of declines (not including effects of possible shut-ins). Demand for injection and related in-state produced water transport in New Mexico should continue even at a 60% decline in completion levels, whereas in the area, other water-related services may experience volumetric changes that generally track completion rate changes. Assuming we continue to be good recyclers, gradually increasing and improving our recycle ratio each year, most of the other water-related services should mirror the decline in completion rates provided we don’t go below 40% of 2019 completions.

In the New Mexico oil and gas landscape, workhorse disposal wells are as close to a revenue buffer as you are likely to find in the larger oilfield service business.

So, for you New Mexico Disposal Well Operators, keep your fingers crossed for no shut-ins, breathe a sigh of relief for now, and tell your investors how smart you are. On second thought, maybe hold off on bragging rights for just a bit longer… who knows what could happen next…!

________________

EnergyMakers helps companies with mission critical permitting requirements, asset packaging and divestiture, due diligence, long term water management planning, disposal well risk management, and regulatory strategies.