On to Part II: Business and Financial implications for shallow well operators and their users.

First, we note that generally across the Midland basin, we see the clearest signs of pressurization amongst the really old EOR wells, which are generally shallow, and tend to be more concentrated near the flanks or edges of the basin and not in the center near the SRA. In the SRA, there is not that much EOR going on, relatively speaking, and the pressures are more moderate. For the last available period (2020), about 50 M barrels went into shallow EOR wells, and about 26.7 M barrels were injected into moderate to shallow SWD wells (< 8,000’).

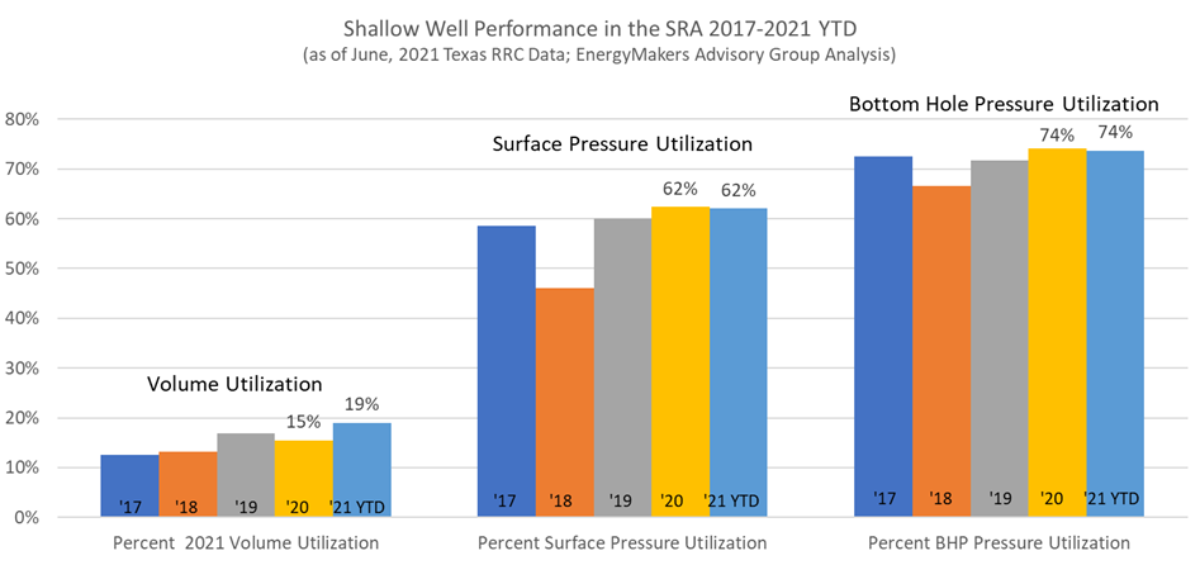

We look at capacity and utilization in three ways: Volume Utilization, Surface Pressure Utilization, and EnergyMakers’ estimate of Bottomhole Pressure (BHP) equivalents. The chart below summarizes the approaches. We’ve been running this analysis about 6 years in a row now and have generated relatively consistent results and trends from year to year.

Note that the first two metrics (surface pressures and daily injection rates) are regulated by the Texas RRC. The third metric, which we obtain by converting “Actual/Reported” Surface Pressures and Maximum Allowable Surface Pressures to their Bottomhole Pressure equivalent, is NOT a regulated metric. However, we believe it is the best of the three metrics to get a sense of SWD future capacities. Once bottomhole pressures start to escalate for a given well, the likelihood is very high that the future capacity of the well will be less than the historic capacity. Said otherwise, in the Midland basin, we believe operators will run into BHP constraints long before they see regulatory constraints from surface pressures or volumes (at least until the RRC imposed the new restrictions.) In addition, SWD well operators will reach maximum “allowable surface pressures” long before they attain maximum allowable volumes. By looking at BHP utilization, we can generally predict which wells are likely to be the most constrained in growth going forward. Using this method, we discovered there were serious issues in shallow wells in New Mexico several years before pressurization issues became evident through surface pressure readings alone.

For the Shallow Wells in the Midland SRA, based on the available data as of June of 2021, only one well (at that time) was approaching the newly imposed “voluntary” limit of 10,000 bbl/d, although several showed rates approaching that level. The vast majority operated at less 3,500 bbl/d over the last five years, with relatively modest year to year growth.

The chart above suggests that perhaps 3-4 shallow wells may be restricted based on volumes going forward if their rates were to continue to increase.

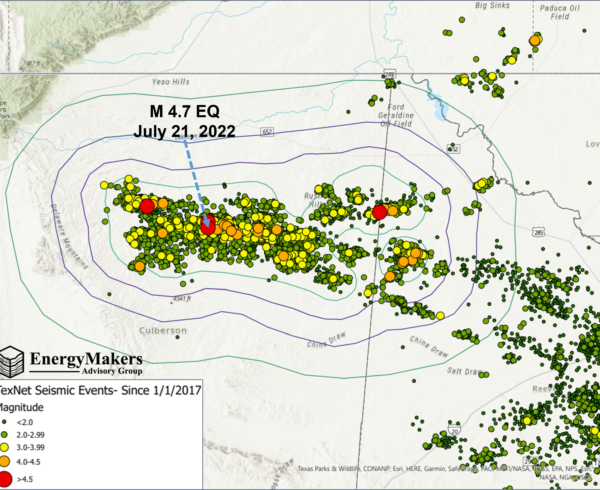

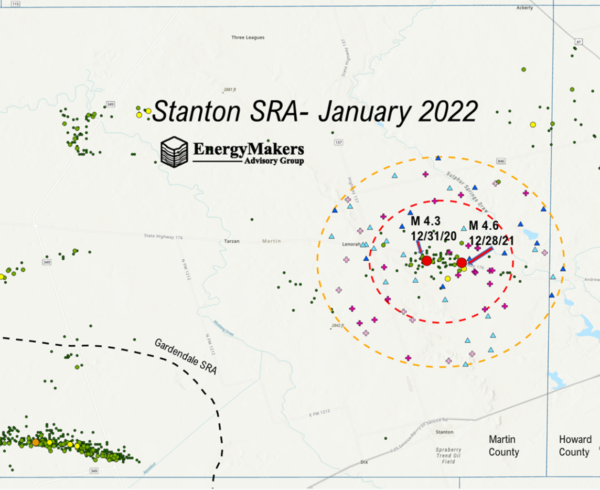

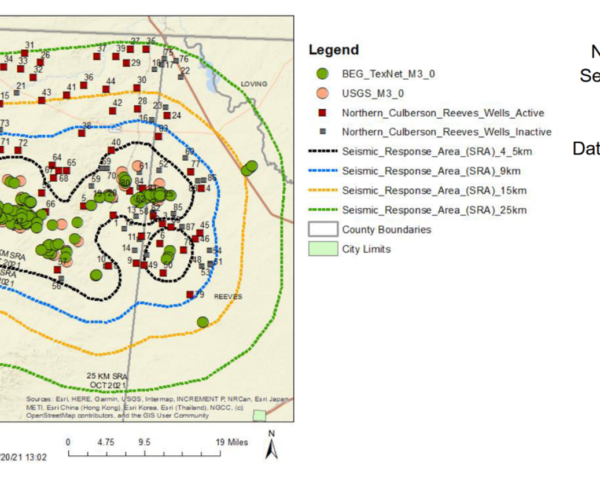

Our best method to estimate future growth capacity is to look at various utilization metrics applied to all wells in the region. As stated in the earlier blog, we did not identify any obviously troubled wells injecting at escalating volumes or extraordinary pressures, or pressure increases. EOR wells were not strongly impacting pressurization schemes in the area, either. However, the shallow-moderate SWD wells show signs of “normal” and gradual aging with utilization metrics gradually increasing:

The trends above are quite typical for the Permian and the Midland basin specifically. Surface pressure utilization is often more than twice volumetric utilization. The data suggests that with 62% surface pressure utilization, SWD operators will “max out” allowable surface pressures long before they hit maximum allowable volumes. 2021 surface pressure utilization readings indicate volumetric utilization will be on the order of 31-40% by the time surface pressures are maxed out. EnergyMakers’ believes the equivalent BHP utilization metrics are an even better future capacity indicator than surface pressures, suggesting there may be as little as 26% available growth on these wells, before they start showing signs of a notable pressure response.

We’ve tried to summarize all of these factors in the chart below. Our conclusions for Shallow-Moderate SWD well operators are as follows:

· While theoretical volumetric restrictions were reduced from 173 M bbls/year to 106 M bbls/year, operators were never really going to see those volumes attained. They will cap out on either surface pressures or bottomhole pressures long before those volumes could be attained.

· Based on surface pressures alone, the shallow SWD wells, which we estimate are injecting 32 M barrels per year in 2021, (up from 26.7M BBL reported in 2020 as of June, 2021) would only see another 19-20 M barrels of growth (61% over estimated 2021 volumes) before a pressure response is noted. (This is being “generous” from our perspective.)

· We believe the more realistic practical limitation is to look at BHP trends, which suggest operators may only see another 11-12 M bbls/Year, or about 36% volumetric growth before showing signs of pressurization.

While impacts on shallow – moderate SWD wells in the SRA are not as severe as the restriction appears, it is only because the initial volumetric limit would never have been attained, nor will the new limit be attained, we believe. Still, not good news for the owners and operators of these wells which now have restricted growth prospects, per the Texas RRC.

The news for deep SWD well owners in the SRA is substantially more sobering, and we’ll cover that in the next blog.

In addition, the real “pain” to industry will be felt about a year out, as a result of restrictions on new wells coming online. The combination of restricting capacity on existing wells, plus eliminating any/all incremental capacity from new SWD wells, will be felt sooner rather than later. These combined restrictions will be significant not only to the SRA, but also adjacent regions.

Lastly, it is possible that perceptions about the restriction, and the “panic” psychology around an abruptly restricted supply of SWD, can have very real impacts on investor mindsets. That’s good news for recyclers and those moving towards beneficial reuse and sobering news for deep well investors.

The Bottom Line: Volumetric restrictions in SWD wells are likely a sign of times to come, and it’s best we deal with it early and head-on, rather than becoming victims of inaction. If you are not ramping up recycling, you will be the first to feel the pain. Secondly, industry must do more to understand seismic causation in the region, and not let our fate be determined through a lack of scientific due diligence.