The Produced Water Society recently reached out to Laura Capper, founder and CEO of EnergyMakers Advisory Group (EMAG), regarding the recent seismicity in the Delaware Basin, including a 5.0 M earthquake between Midland and El Paso. Below is the full text of the article.

Despite inconclusive research on induced seismicity and saltwater disposal in the Texas Delaware Basin, regulators are erring on the side of caution to the detriment of the industry.

On March 26, 2020 the US Geological Survey registered a 5.0-magnitude (ML) earthquake near the Texas-New Mexico border. In the aftermath, local media was quick to speculate that the quake was linked to saltwater disposal via injection, as it occurred in an active oil & gas region of the Delaware Basin. According to Laura Capper, founder and CEO of EnergyMakers Advisory Group (EMAG), those inferences were hasty and based on inconclusive or misinterpreted evidence.

Delaware induced seismicity has been observed since January 2017,when the TexNet Seismic Monitoring Program was commissioned. Though researchers have studied the issue, there has not been a scientific consensus that injection is the main culprit in that area, as has been determined in places such as Oklahoma and Arkansas.

“There is strong data that suggests much of recent seismicity is caused by injection in areas like Oklahoma,” Capper told Water in Oil. “I have not seen data that is equally strong in the Delaware, so I think the jury is very much still out on the true causes.”

The scope of the research conducted so far has considered a narrow set of variables rather than a thorough analysis of all the possible factors. Capper questions why researchers have focused on only a subset of possible causes, largely restricting their investigations to injection and hydraulic fracturing, without considering effects from natural seismicity, production and subsidence, and other far-field effects.

“There is no one smoking gun. Induced seismicity likely stems from a more complicated set of behaviors,” she said. “Researchers must look at the effects of all the activities going on to understand where the correlations might be.”

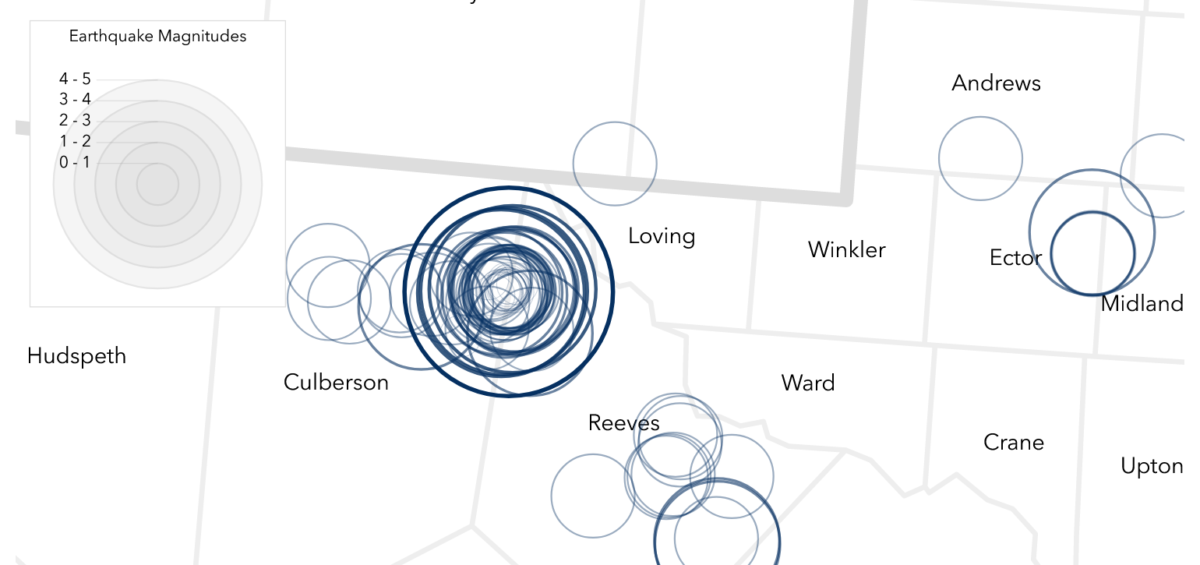

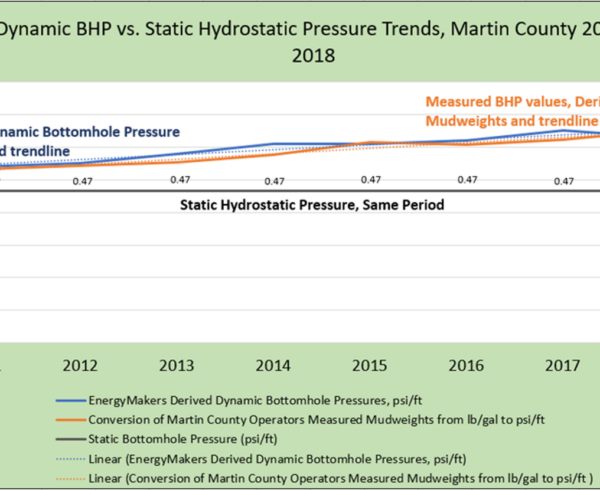

EMAG has assessed earthquake, injection, completions and production data in the vicinity of the recent 5.0-ML tremor. The firm found that several earthquakes in the area were registered at depths of 22,000 ft and deeper, and injection is mainly performed at depths above 8,000 ft. New well completions (depths of around 9,000-10,500 ft) and local production (as deep as 18,950 ft) are both occurring much closer than disposal activity to the recorded earthquake hypocenters. Additionally, lateral lengths are moving towards 2 miles, which increases their chances of encountering modest faults.

This very basic consideration of vertical separation alone suggests that induced seismicity may be more closely tied to production or hydraulic fracturing than disposal in the Delaware Basin. “I have not seen any data that suggests induced seismicity is caused by injection in this region,” Capper said. “But several studies indicate some 2-5% of the quakes in the Delaware Basin may correlate with fracking.”

Another factor that deserves consideration is that the total volume of oil, gas and water extracted from the subsurface is much greater than the volume of reinjected water. Logic suggests pressure changes from production or extraction could exceed pressure changes from injection of only the water component.

The depressurization, compaction and settling of the subsurface due to tremendous oil & gas activity over a long period of time should also be contemplated. Given the geology and hydrogeologic flows of the deep Delaware Basin, pressure dynamics associated with settling and compaction may be felt many miles away from the source and could contribute to far-field seismic responses.

SEISMIC ACTIVITY

Nearly 100 seismic events were recorded in this area for the March 21-29 period. TexNet has registered the March 26 event at 4.6 ML, while USGS has labelled it as a 5.0-ML quake.

TexNet Seismic Monitoring Program

The quality of the available data itself can also limit researchers’ abilities to pinpoint the cause of the basin’s seismicity. For example, the margin of error for earthquake data can put recorded earthquake locations at plus or minus 8,000 ft of their actual hypocenters, making it difficult to accurately place earthquakes within a very specific geographical location.

Yet another issue is that the injection data made available by the Texas Railroad Commission (RRC) typically lags 15-18 months behind activity, while completions data is sometimes not published until 4-6 months after it has been reported.

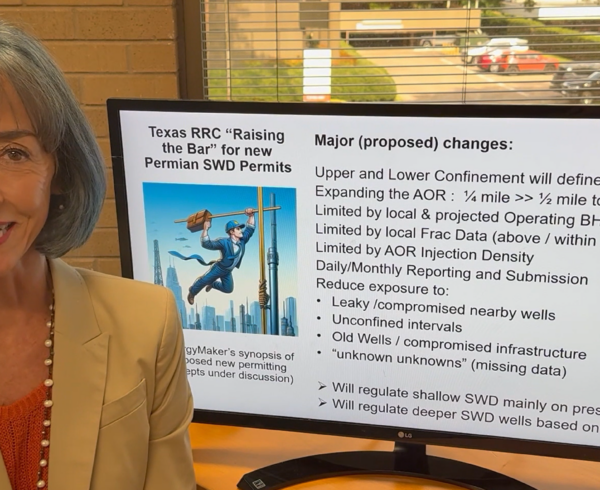

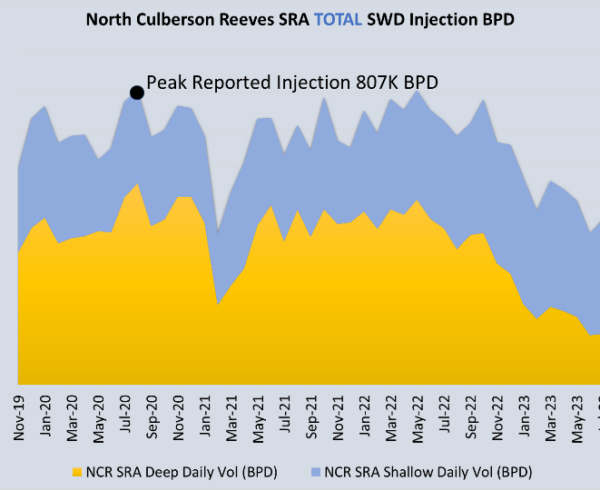

The absence of complete research on seismicity has had severe repercussions for the industry. Taking a conservative stance, the RRC in February 2019 adopted new policies that have impacted disposal practices in the Delaware Basin. In addition to moderating the pace at which new injection capacity comes online, the agency established guidelines that may restrict disposal operations in seismically active and geologically complex areas.

Maximum allowable injection pressures for saltwater disposal wells (SWDs) had historically been 0.5 psi/ft, but the RRC is now granting SWD permits with pressure gradients as low as 0.25 psi/ft in some cases.

“It substantially changes the economics of your disposal well,” Capper explained. “If you can only operate at half the pressure, it very likely means you are not going to be able to achieve even half the volumes that you would have gotten prior to the adoption of the new guidelines.”

SWD operators may also face delays of a year or more if their applications are put into a seismic review process or protested by other parties. In those situations, applicants must submit additional data. The expense of hiring specialized consultants to gather this information combined with operational delays can represent a hefty financial burden.

Capper believes that we have reached a critical inflection point as the industry faces pressures from low oil prices and market instability due to the COVID-19 pandemic and low oil demand.

“The cost and operational consequences of restricting new disposal capacity are literally pushing businesses into the red faster – possibly faster than we can dial back from. If there is a real plan to identify seismic causation in the Delaware Basin, the industry deserves to know what it is, who is responsible and, most importantly, what the timeline is,” Capper told Water in Oil. “If there is no such plan, then in the absence of consequences to health, safety and the environment, it is time to take the foot off the breaks and continue permitting SWDs where we need them most – in the Permian Basin.”

Learn more about produced water challenges and how they are being addressed by the industry at https://www.producedwatersociety.com