In our last blog, we reported the short-term impact of the SWD volumetric restrictions on shallow well operators in the SRA region –at the intersection of Andrews, Martin, Ector, and Midland counties. The 29 active SWD wells injecting at less than 8,000’, currently injecting at about 32 M barrels a year (estimate) will find their incremental volumetric growth capped at 73 M barrels per year under the new restrictions, whereas before the restriction they could have added another 140 M barrels a year according to volumetric limits. However, those shallower wells will encounter practical pressure constraints, we believe, long before attaining new or old regulatory limits and are therefore only likely to achieve max injection rates of 40-50 M barrels a year in total. In addition, no new SWD wells can be brought online in the region, a severely limiting factor.

The story is more consequential to owners of deep SWD wells in the SRA region.

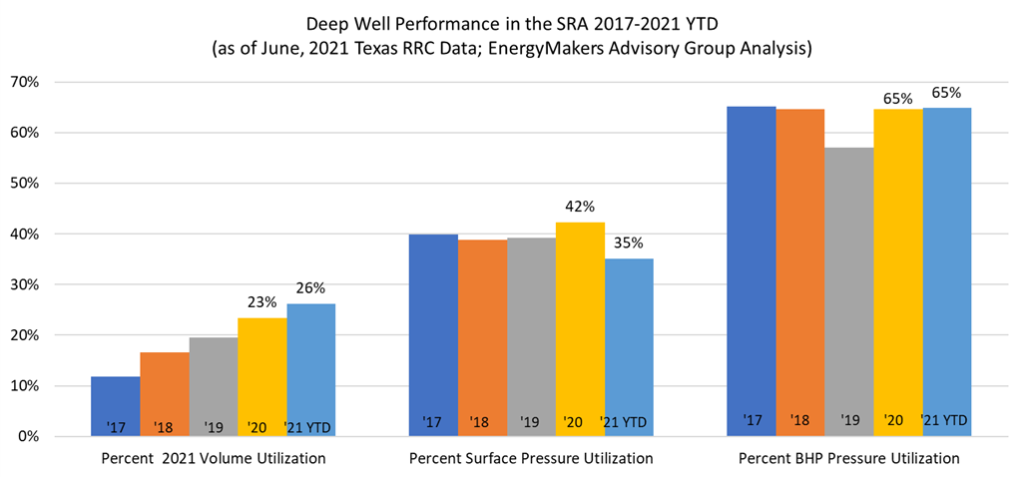

Based on data available as of June of 2021, the 17 deep SWD injectors appeared to be operating reliably and well-under regulatory volume and pressure limits. We also investigated their bottomhole pressure (BHP) performance (by deriving bottomhole pressure equivalents from max surface pressure limits and reported surface pressures along with other data required for the estimate) and found that they had very healthy bottomhole pressures, with no obvious signs of concerning pressure problems. An exploration of all three key metrics suggests these wells have ample room for growth before they would normally encounter either pressure restrictions or regulatory restrictions were it not for the new restrictions. As of last available complete data, the wells were only using 26% of allowable volumes and 35-40% of available surface pressure maximums, both set by the Texas RRC. Their BHP utilization was also very moderate at 65% with plenty of runway. (Note: BHP is not a regulated metric.)

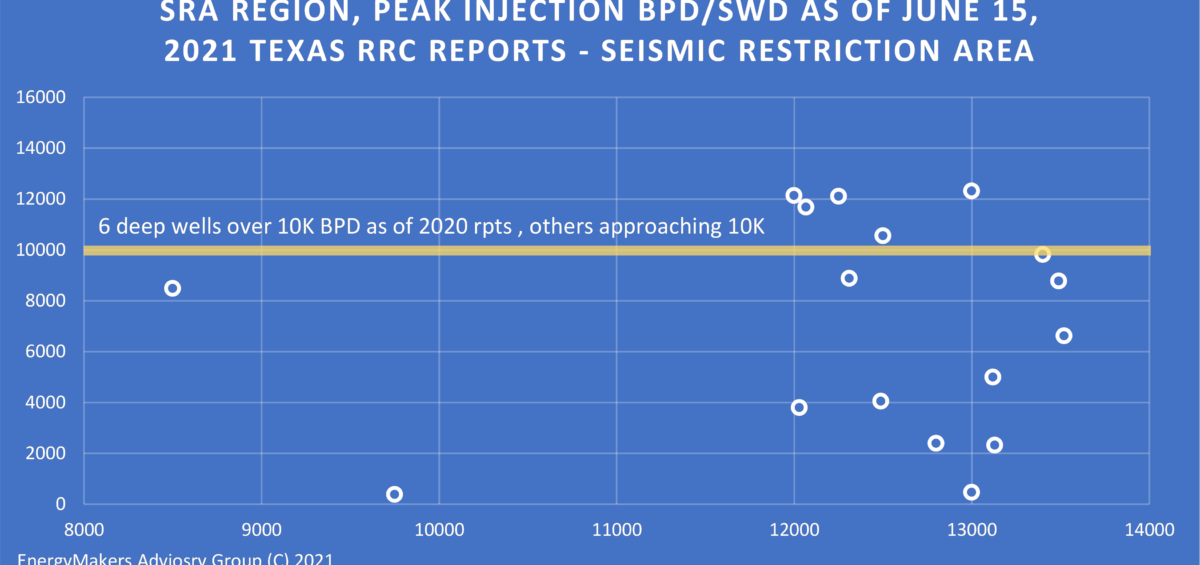

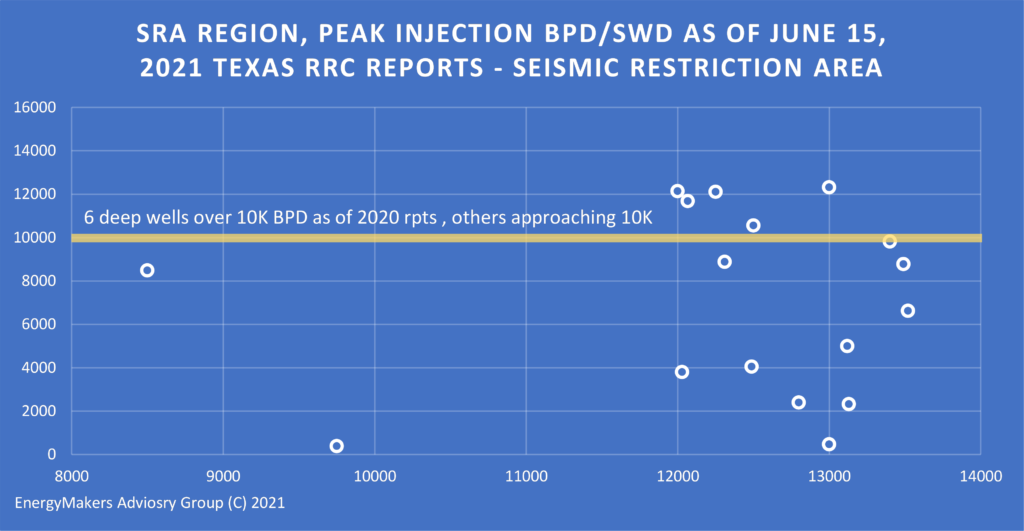

As of data available June of 2021, 6 deep wells were over the 10,000 bbl/d rate. However, late 2020 and 2021 are high-growth SWD years, as we recover from Covid and downturns, and most if not all daily injection rates are significantly higher, today. So very likely in today’s terms at least, half of these deep wells will likely have their volumes curtailed effective immediately.

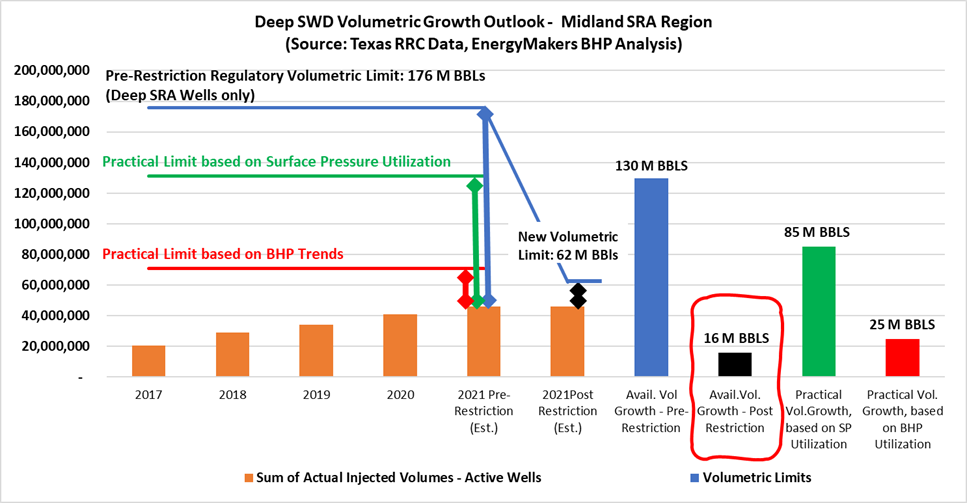

We estimate the 17 active deep SWD wells, including those injecting over 10,000 bbl/d, were injecting 46 M bbl/d in 2021 (up from 41 M bbl/d in 2020) before the new restrictions. Pre-restriction, there was an allowable 130 M bbl/d of incremental growth, or volumetric “runway”, before volume limits would be attained. With the new restriction that growth dropped from 130 M bbl/yr, to 16.1 M bbl/yr.

In terms of daily injection volumes, or BPDs (bbl/d), for deep wells, they were injecting at 126 K bbl/d, and the old volumetric limit was 481 K bbl/d. The new limit is 170 K bbl/d, allowing just 44 K bbl/dgrowth for the region, before all wells hit the 10K bbl/d cap.

Given that most shallow wells in the area are unlikely to attain 10K bbl/d without running into pressure restrictions, we believe more conservative operators may prefer their water to go into these deeper, more receptive wells. If current growth rates continue, the deep well maximums will be hit within two years. However, if the market responds by avoiding the shallower wells, the deep wells could reach the new maximums much sooner.

We also provide independent estimates of what we believe the wells will find as a practical volumetric peak based on regulatory surface pressure limits, along with our conversion to bottomhole pressure equivalents / proxies. Our more conservative method of estimating future well capacity suggests these wells, were they not restricted, should be able to handle an incremental 85 M barrels, or 233 K bbl/d, based on their surface pressure utilization, and incremental growth of 25 M barrels, 68 K bbl/d, based on BHP utilization.

No matter which method you lean towards to gauge future well capacity, the SRA region will take a substantial hit on its water balances and specifically its ability to continue relying on deep well injection, which is currently processing more than 50% of the produced water in the area.

Summary Impacts for the Region

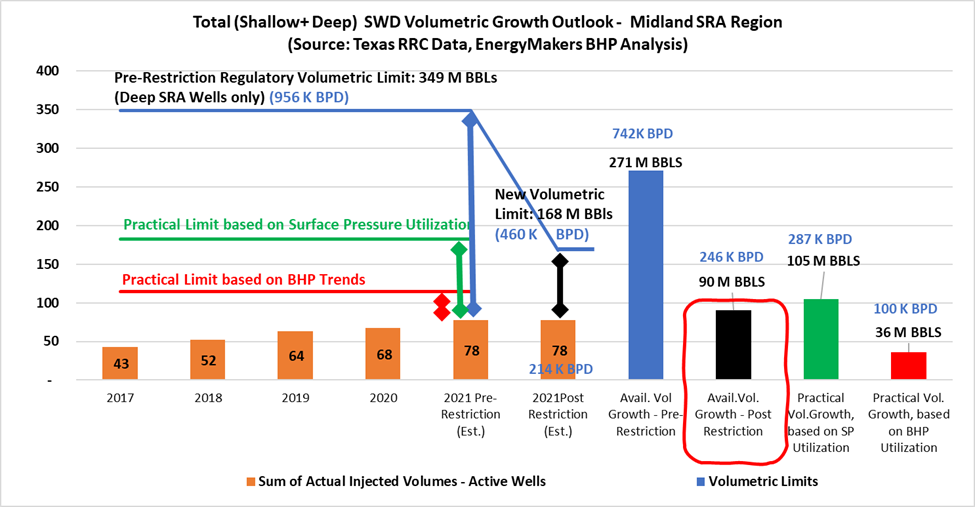

If we add the combined effect of deep and shallow injection in the area, operators went into the year thinking they had up to 956K bbl/d they could inject. The new restriction halved that amount, down to 460K bbl/d. Currently, we estimate operators are injecting about 215 K bbl/d in the SRA area. Available volumetric growth in the area dropped by 2/3 for currently active wells alone, from 742K bbl/d to 246 K bbl/d.

From a practical or more conservative standpoint, EnergyMakers’ believes that incremental well growth in the area is someplace between 100 K bbl/d and 287 K bbl/d, based on our pressure analysis studies.

In addition, the restriction of any new SWD wells coming online means no relief is in site—we have to make do with the 46 SWD wells operating in the area. That is an expensive price to pay for those companies who paid the price to obtain permits for wells that they will receive no benefit from.

Almost all of the real “financial pain” will be taken by deep well operators, whose wells were operating substantially under regulatory limits and had lots of growth runway. We believe a couple of things will happen as a result of the new restrictions, with the brunt of the pain felt next year (unless restrictions are lifted).

· Recycling will reach peak levels, just as soon as operators can manage the logistics. But, that won’t solve the problem.

· Conservative operators may send their shallow well injection to deeper formations, which may in turn cause an increase in injection up until the voluntary limits of 10K bbl/d are attained.

· Limited area SWD supply will probably cause an over-response from the market. Expect prices for everything related to water management in this area to go up.

· Owners of deep wells in the area can afford to be very selective with regards to whose water they agree to take. There is now a seriously constrained market. The commodity just moved to premium pricing.

· Owners of deep SWD wells in adjacent regions will also see their demand go up, and prices go up, most likely.

· The larger hit will be to industry as a whole, however, which is now going to haul an increasing percentage of its produced water further away (in direct opposition to most ESG initiatives, interestingly!)

· In the absence of allowable Beneficial Reuse in Texas – if operators can’t haul their water further away to receptive SWD, their last alternative is to constrain production. An obvious place to start is with all the legacy conventional wells with very high water cuts.

If indeed deep injection is a contributing cause to seismicity, by holding aggregate volumes flat, and limiting existing wells to 10,000 bbl/d, we would expect to see some abatement in reservoir pressures. However, that can take a year or more to realize. If deep injection is the dominant contributing cause to seismicity in the area, we would also expect some abatement in seismic activity within the year after injection growth is curtailed.

We’ll be talking about this, and more, at Friday’s Oilfield Water Connection conference in Houston!

Big outstanding questions we have:

What happens if an operator elects not to voluntarily comply with “the request”?

If seismicity abates, will the RRC ease the voluntary restrictions?

What studies are being completed in the area to determine seismicity causation? Further, will those studies evaluate other plausible correlations, including hydraulic fracturing, natural settling and compaction, and production / extraction?

How will our science be advanced, going forward?

Join us for what is certain to be a spirited debate about this and other newsworthy topics!