This is the second of a series of observations from EnergyMakers’ New Mexico Deep SWD Report, where we explore the practical capacity of New Mexico’s growing Deep SWD infrastructure, and what we can expect going forward.

We have long warned that pressure limits are more likely to be constraining factors than volumetric limits in the Permian, meaning disposal well operators will max out on their surface pressure limits long before they attain their permitted volumes.

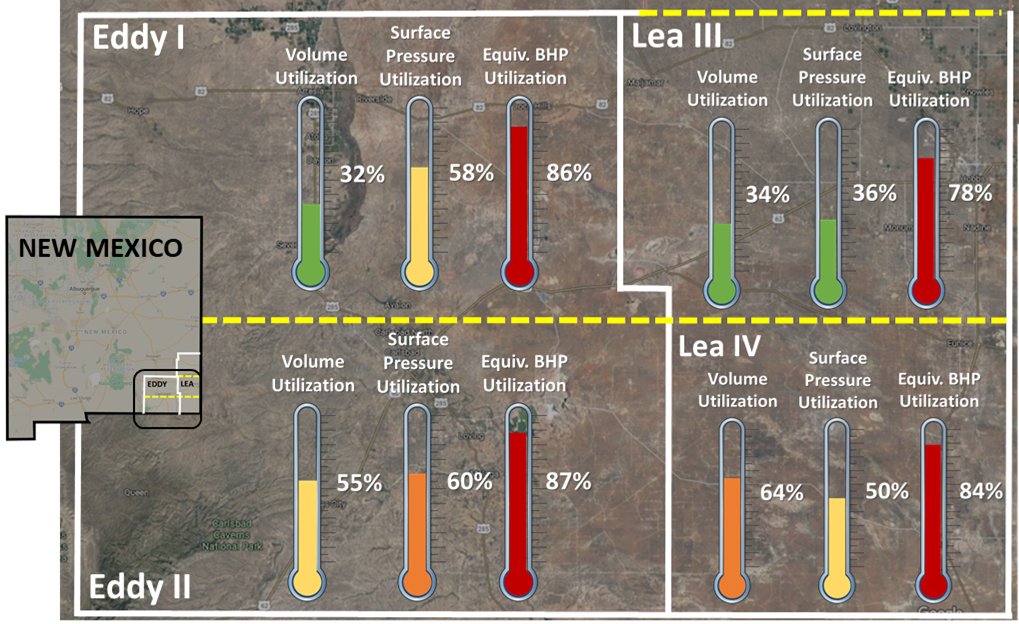

In New Mexico, the regulators are doing a pretty decent job at assigning permit limits, such that volume and surface pressure utilization are generally on par. The notable exception to this is in Northern Eddy County, where surface pressure utilization (58%) is almost twice that of permitted volume utilization (32%), suggesting that few, if any, deep wells in the area will achieve their volumetric goals.

Our analysis of derived SWD bottomhole pressures in the area, however, suggests the future growth of these deep SWD wells in SE New Mexico is more limited than we thought. Note that only surface pressures are regulated in New Mexico and other states. Bottomhole pressure escalation from injection (while not regulated) becomes evident long before Surface Pressure escalation becomes obvious. EnergyMakers’ uses BHP trends to better-predict future well performance, and for early warning signs of capacity decline.

By converting NMOCD Maximum Injection Surface pressures to their Bottomhole pressure (BHP) equivalents, EnergyMakers’ Advisory Group finds that operators are actually using between 78 – 87% of regulators “intended” subsurface pressure allocation. BHP impacts, we believe, will be observed long before permitted volumetric goals are attained.

We would be surprised to see more than 10-20% volumetric growth going into these newer deep wells, based on 2019 and 2020 performance reports. That is good news for disposal well drillers and tubing sales because more wells will be needed. For operators, however, this is yet another reason to dial back their reliance on SWD wells and lean in to recycling sooner rather than later. Short term recycling challenges should translate to a more competitive industry positioning, along with liability reductions going forward, we believe!